Small Estate Probate California: A 2026 Guide

April 1, 2025

Changes to California Probate Laws in 2025

Starting April 1, 2025, California is making it easier and faster for families to handle small estates after a loved one passes away. Thanks to Assembly Bill 2016 (AB 2016), more estates will qualify for simplified probate procedures, meaning lower costs and fewer court delays.

However, even under the new rules, Category 2 and 3 still require a probate court case. That means all heirs and beneficiaries must be located, cooperative, and willing to sign the required documents. If there is disagreement, missing heirs, or unwillingness to participate, full probate is typically the only option.

If you’re dealing with an estate in Category 2 or 3, working with an experienced probate attorney is the best way to ensure a smooth process.

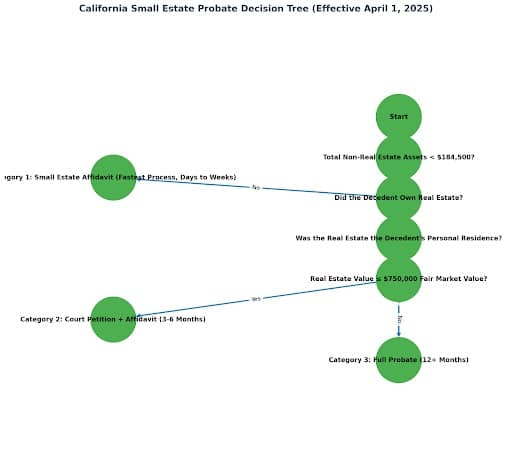

How Do You Know If You Qualify?

To determine if you can use the new simplified probate process, ask yourself:

✅ Are your loved one’s total non-real estate assets worth less than $184,500?

✅ Did the decedent own a home worth less than $750,000 (fair market value)?

✅Are heirs and beneficiaries willing to cooperate, and sign the required documents?

Based on the answers, estates will fall into one of three categories:

Category 1: Estates Under $184,500 With No Real Estate

Use: Small Estate Affidavit (Probate Code §§ 13101-13111)

- The total value of the estate’s personal property (bank accounts, cars, valuables, etc.) is less than $184,500

- And the decedent did not own real estate

- ✅ You can use a Small Estate Affidavit instead of going to probate court

- 🕒 Fastest and easiest process—can often be completed in days or weeks, depending on the number and location of beneficiaries or heirs

- ⚠️ All heirs and beneficiaries must sign the Affidavit—if anyone is missing or uncooperative, this option won’t work.

Category 2: Estates Under $184,500 With One Personal Residence (Worth No More Than $750,000 Fair Market Value)

Use: Petition to Determine Succession (Probate Code §§ 13151-13158) & Small Estate Affidavit

- The total value of the estate’s personal property is still under $184,500

- And the decedent owned only one real estate property that:

- Was their personal residence

- Is worth $750,000 or less (fair market value)

- ✅ You must get a Probate Court Order, but probate may be expedited with a single petition and court appearance

- ✅ You can use the Small Estate Affidavit for everything else

- 🕒 Typically completed within 6 to 9 months, depending on how busy the County’s Probate Court is. The busier the court, the longer it takes to schedule a hearing.

- ⚠️ This is a probate court case, so hiring an expert probate attorney will help ensure the process goes smoothly.

- ⚠️ All heirs and beneficiaries must sign both the Affidavit and the Court Petition—if any heir is missing, uncooperative, or disputes the inheritance, full probate will likely be required.

Category 3: Estates That Don’t Qualify for Category 1 or 2

Process: Full Probate Administration

If any of the following apply, the estate must go through full probate court:

- The estates total assets is more than $184,500

- Or the decedent owned more than one real estate property

- Or the real estate is worth more than $750,000 (fair market value)

- Or there are heirs or beneficiaries who can’t be located, won’t cooperate, or are disputing the estate

⚠️ This is a formal probate court case, which can take 12 months or longer. Working with an expert probate attorney is the best way to navigate the process efficiently. We have a structured process to help guide you through the probate process and work with vendors that specialize in probate to help cut down time so that you can get your inheritance faster.

What Should You Do Next?

If you’ve recently lost a loved one, check if their estate qualifies under these new rules. If it does, you may be able to transfer assets much faster—as long as all heirs cooperate.

However, if the estate falls into Category 2 or 3, hiring an experienced probate attorney is the best way to ensure success. A skilled attorney can avoid mistakes, speed up court filings, and handle any disputes that arise.

Lawvex Expert Probate Attorneys

Catarina Benitez

Logan Howard

Amanda Neal

Yanet Morales

Jordan Orozco